The global graphite electrode market size was valued at USD 3.83 billion in 2020 and is anticipated to grow on account of increasing steel production through electric arc furnace (EAF) route in developed as well as developing nations. Excellent temperature resistance, high electrical & thermal conductivity, and ultra-high bending resistance of these materials are expected to augment growth over the forecast period.

Global graphite electrode market www.aohuicorp.com

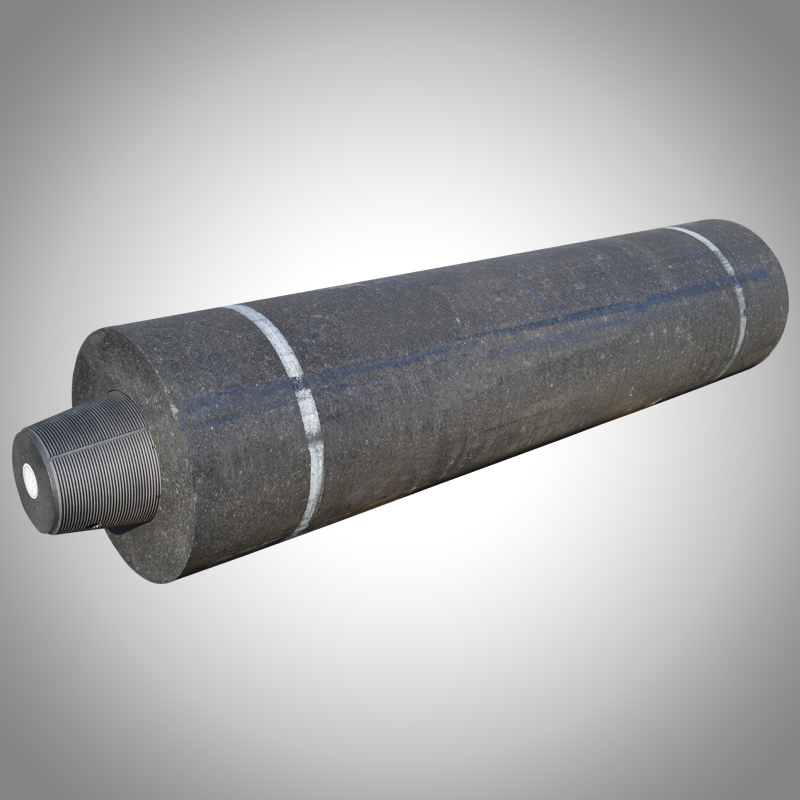

Graphite electrodes are used in electric arc furnace (EAF) and ladle furnace (LF) for steel production, ferroalloy production, silicon metal production and smelting processes. The tip of these electrodes can reach up to 3000oC, which is approximately half the temperature of the sun. In addition to excellent mechanical strength, thermal expansion, thermal shock resistance and machinability, the high temperature helps in reducing the entire mass of steel.

Growing demand for steel in construction, oil & gas, and automotive industries is expected to boost the graphite electrode market. In 2020, approximately 50% of the steel produced globally was used in the building & infrastructure industry. Growing demand for steel in diverse industries such as aviation, electronics and packaging is anticipated to boost the use of electric arc furnace route for production thereby increasing the demand.

Volatile raw material prices are expected to restrain market growth as they have an adverse impact on supply as well as profit margins of manufacturers. Needle coke is primarily used for the manufacturing of graphite electrode accounting for approximately 40% of the total cost of the finished product. Fluctuation in the global crude oil price is expected to hamper the growth of needle coke market.

Segmentation by Product

• Ultra-high power (UHP)

• High power (HP)

• Regular power (RP)

Ultra-high power (UHP) graphite electrodes were widely used accounting for 65.4% of the revenue share and are expected to continue its dominance over the forecast period. Rapid industrialisation and increasing infrastructure spending are likely to increase the demand for high-grade steel.

High power graphite electrodes are used for manufacturing non-ferrous metals and medium-and low-grade steel through electric arc furnace and ladle furnace. It is made up of premium quality of petroleum coke with Anshan pitch and 30% needle coke.

Segmentation by Application

• Electric Arc Furnace (EAF)

• Ladle Furnace (LF) & Others

In 2020, EAF was the largest application segment in terms of value as well as volume owing to the rising adoption electric arc furnace route for steel manufacturing. The segment is anticipated to grow at a CAGR of 5.2% over the forecast period.

Graphite electrodes are utilised in electric arc furnace for steel manufacturing and refinement process. Increasing use of the material in electric arc furnace for metal melting process and steel scrap will increase the demand for the material over projected period.

Countries such as the U.S., Japan, and India along with the Middle East have the highest exposure to EAF route. In 2020, in India, nearly 60% of the steel was produced through the EAF route, whereas, it was nearly 90% in the Middle East.

Segmentation by Region

• North America

• Mexico

• Europe

• France

• Asia Pacific

• China

• Japan

• India

• Central & South America

• MEA

Asia Pacific dominated the global market in 2020 and is expected to witness significant volume growth at a 4.4% CAGR on account of rapid industrialization and construction of commercial & residential buildings. Growing use of electric arc furnace route for steel production in emerging economies will augment the demand for graphite electrodes.

Steel production through electric arc furnace has traditionally remained stable in the developed economies of Europe and North America due to the high availability of scrap. These regions together accounted for 44.3% of the graphite electrode consumption in 2020.

Competitive Landscape

The global market is concentrated and competitive with the presence of few players such as GrafTech International, Graphite India Limited SGL Carbon SE, Ao Hui Carbon Company and HEG Limited. Companies are adopting strategies such as merger & acquisition strategy to expand their presence in global market. For instance, in October 2020, Showa Denko acquired SGL GE to expand its presence in the global market. At present, it has the largest manufacturing capacity for graphite electrodes in the world.

Post time: Jul-03-2020